Should an expense come into question by the IRS, it is your responsibility as a business owner to prove its legitimacy. Proper receipts help demonstrate that an expense can be appropriately classified as a legitimate business expense. If you plan on writing off an expense on your taxes, you better be prepared to provide documentation that you made that purchase for your business. There's much less harm in keeping a receipt you don't need than in tossing one you do. When debating whether or not you should keep a receipt, it’s always better to play it safe and err on the side of caution. Repeat after us: It's better to be safe than sorry.

Fortunately, we’re here to keep you in the clear by sharing three things you need to know about receipts as a small business owner. If you don’t know the answers to these questions, you could end up in hot water with the IRS.

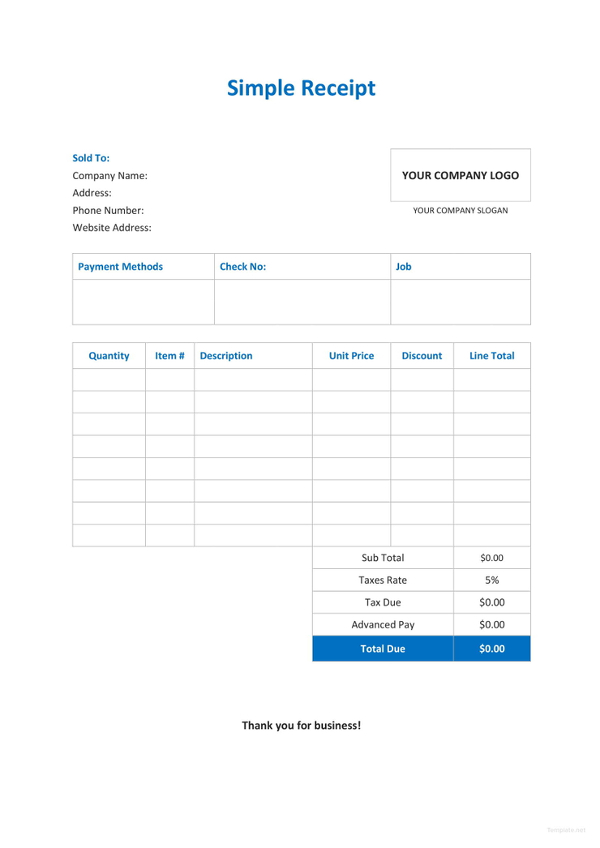

#BUSINESS RECEIPTS FULL#

But however big of a headache receipts may cause you, they’re necessary for good recordkeeping and for lawfully deducting business expenses.īut just how full should your shoebox of receipts be? Do you really need to keep every receipt? And for how long? And what happens if a receipt goes missing? Many business owners might even call them their nemesis.

0 kommentar(er)

0 kommentar(er)